|

| Source: The Edge Financial Daily |

Wednesday 31 December 2014

Wednesday 26 November 2014

Saturday 22 November 2014

Tuesday 18 November 2014

Tuesday 28 October 2014

Matrix Concepts: Sitting tight in Negeri Sembilan

The Seremban-based property developer is a burgeoning property player. A strong performance in its second quarter as well as the recent purchase of a 164-acre piece of land to replenish its land bank led to great optimism among analysts. Yet its share price has been on a downtrend lately.

Business model: Established in 1996, Matrix Concepts Holdings Bhd started off as a property development company in Negeri Sembilan. In 2004, its acquisition of another property developer, Seventech Sdn Bhd, saw Matrix Concepts expanding into Johor. It went public in the same year and subsequently went into joint-venture (JV) with Kemajuan Tanah Negeri Johor Bhd and Menteri Besar Incorporated.

The group was listed on the main market of Bursa Malaysia Securities Berhad on May 28, 2013.

Its primary activities are investment holding, property development and construction. The group has undertaken various township developments in Kluang and Seremban as well as residential and commercial projects in Seremban. Bandar Sri Sendayan in Negeri Sembilan is thus far the group’s largest project and constitutes 79.7% of revenue in 2013.

Others include Sendayan TechValley as well as Taman Sri Impian in Kluang. In 2011, it signed a memorandum of understanding (MoU) with six foreign companies from Japan, Taiwan, Hong Kong and France for the sale of industrial lots at Sendayan TechValley 2 in Negeri Sembilan.

According to the group it has to-date successfully built and sold 22,000 residential and commercial properties with a gross development value (GDV) of RM2.5 billion.

Shareholder and management assessment: The company’s major shareholders include its founder, Lee Tian Hock, who is also managing director and CEO. He currently owns a substantial 19.81% of the company’s shares followed by Shining Term Sdn Bhd which holds 15.93%.

Its non-independent non-executive chairman Mohamad Haslah Mohamad Amin spent 20 years in Maybank Bhd and had previously served various foreign companies namely Peregrine Fixed Income Ltd in Hong Kong, Fleet Boston NA in Singapore as well as Pacific Plywood Holdings Ltd in Hong Kong.

Lee has had 30 years of experience in the property development industry and prior to founding the group, he held various executive positions in several property development companies. He currently leads the group’s business direction and overall strategies and policies.

Matrix Concepts 1 year price performanceShare performance: Matrix Concepts has been trading in a 52-week range of RM1.89 to RM3.32 with an annual return of 62.99% and has far surpassed the FBM KLCI benchmark of 3.04%. However, there has been a slump in the share price since late September when it plunged to RM2.74, an all-time low since experiencing a general uptrend in mid-June.

As at Oct 23, it was trading at RM2.96 up 0.06 sen.

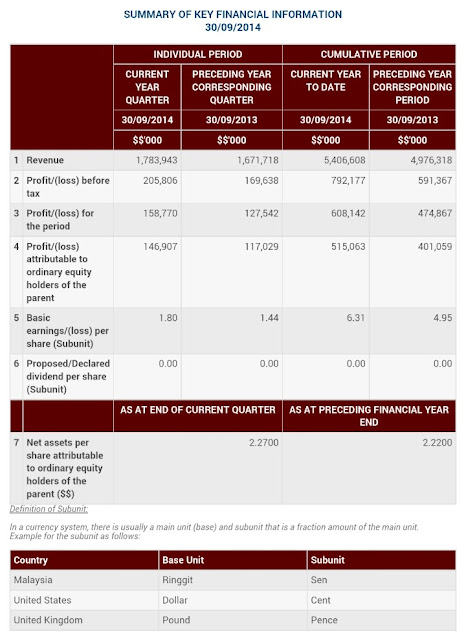

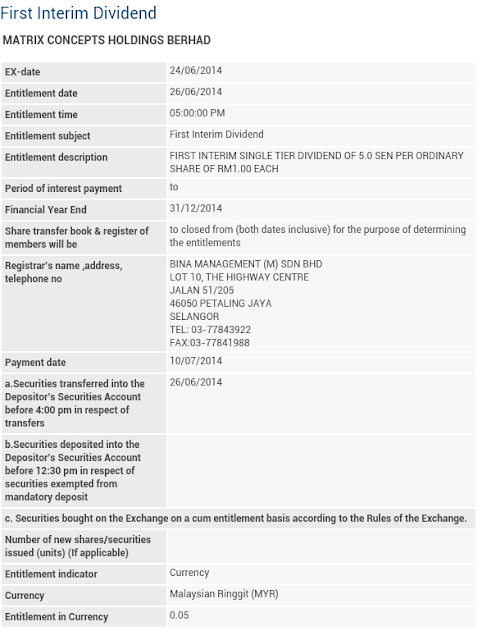

Analyst calls on Matrix Concepts Holdings 231014What analysts think: Analysts are on the whole positive. The group currently registered revenue of RM163.7 million for the second quarter of the financial year ending Dec 31, 2014 (2QFY14) compared to RM147.3 million in last year’s corresponding quarter. Its profit before tax (PBT) for 2QFY14 stands at RM58.6 million compared to last year’s RM40.6million.

Analysts’ optimism stems from the group’s recent purchase of 164 acres of land for RM71.5 million in Sendayan, Negeri Sembilan to replenish its industrial land bank. The pricing of the land is deemed fair to most analysts and is in line with the current market value of RM72 million.

Earnings forecast:

Earnings forecast for Matrix Concepts Holdings 231014

StockStalk: The new land slated for the development of a full facility industrial park called Sendayan TechPark is expected to generate GDV of RM170 million. The purchase has now increased the group’s land bank to a total 1,164 acres.

Given the infrastructure in Sendayan TechValley and its close proximity to Greater Klang Valley, Matrix’s industrial land is highly sought after and there would be ready buyers as noted by RHB.

In addition, the selling price is expected to be RM30-RM35 per square feet (psq), which according to RHB would make Matrix rake in a 50% gross margin by selling the industrial land plot and thus retain the group’s overall margin at 30% to 40%.

The group’s higher presence in Negeri Sembilan which is seen as an increasingly thriving satellite city is a reason to be optimistic. However, the lack of landbank diversification means that the group’s “fate is completely tied to that of Seremban” as observed by HongLeong Group.

It is also important to note that Sendayan TechValley has been quite well received with 760 acres sold to date mostly to multinational corporations from Japan, the UK, Germany, France and China.

The share has been experiencing a general downtrend and trading below analyst’s expectation lately. Investors seem to be lukewarm about the announcement since late September but this could probably be a result of overall poor market sentiment. The FBM KLCI has been trading at a near one-year low.

Most of the group’s properties consist of affordable housing which is continuously backed by government support. Kenanga believes that the group is “well positioned in the affordable housing segment coupled with industrial developments within the Greater Klang Valley region”.

Overall analysts are confident about Matrix Concepts’ ability to deliver a similar 2Q14 performance in subsequent quarters due to strong billings, sales take up rates as well as potential land sales.

Source:

www.kinibiz.com/story/stock-stalk/115970/matrix-concepts-sitting-tight-in-negeri-sembilan.html

Wednesday 22 October 2014

Tuesday 21 October 2014

Friday 29 August 2014

Thursday 28 August 2014

Monday 25 August 2014

Friday 22 August 2014

Wednesday 20 August 2014

Tuesday 19 August 2014

Thursday 14 August 2014

Friday 8 August 2014

Friday 25 July 2014

Friday 18 July 2014

Wednesday 16 July 2014

Tuesday 1 July 2014

Rakuten-AirAsia budget airline to take off next year

TOKYO: AirAsia Bhd said on Tuesday it would set up a low-cost airline with Japan's biggest online retailer Rakuten Inc and other firms, marking the budget carrier's second attempt to tap one of Asia's lucrative air travel markets.

The new carrier, AirAsia Japan, will start flying in about a year with a fleet of five aircraft, the carrier's CEO Yoshinori Odagiri told reporters.

The airline will fly to both domestic and international destinations, but has yet to decide which airport it will be based out of, he added.

Rakuten will own an 18% stake in the new airline, while Noevir Holdings Co Ltd, a diversified conglomerate that owns an aircraft leasing business, will own 9%. AirAsia is also partnering with Octave Japan Infrastructure Fund and sports firm Alpen Co Ltd.

The total cost of the venture was not immediately clear.

For AirAsia, the venture is another attempt to expand to Japan after it pulled out of a partnership with the country's biggest carrier ANA Holdings Inc last year.

That venture, launched in 2011, failed to woo travellers and ANA blamed poor marketing and a user-unfriendly website.

The airline has since been rebranded into Vanilla Air, and is now wholly owned by ANA and based out of Tokyo's Narita airport.

"This is AirAsia part two, and I hope there is no part three," Tony Fernandes, the owner and CEO of AirAsia, told reporters in Tokyo.

Rakuten, controlled by Japan's fourth-richest man Hiroshi Mikitani, aims to boost its online travel site through the partnership and create new business to fend off increased competition from the likes of Amazon.com Inc.

Rakuten's travel site is already one of the largest in Japan. Two decades ago, travel company H.I.S pioneered the trend, setting up Skymark Airlines, which is now Japan's leading discount carrier.

Mikitani said he saw great potential in the budget travel market in Japan.

"In America, discount carriers account for 30% of travel. In South-East Asia, it's 50%. In Japan, it's only 3%," he said. – Reuters

Source: theStar

Saturday 21 June 2014

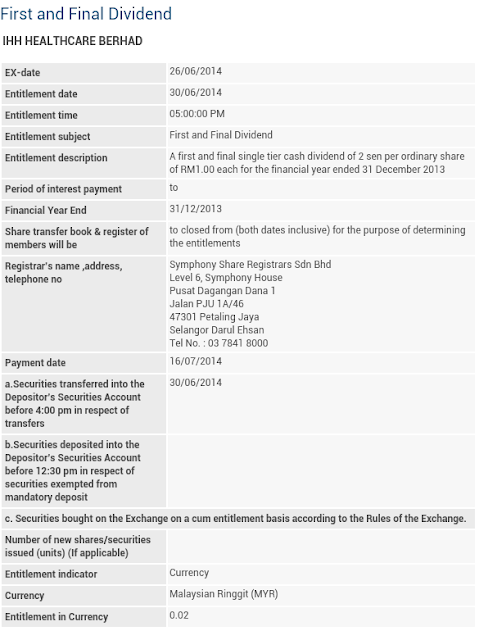

IHH 3年投资34亿增床位 放眼2017年达9000张

(吉隆坡20日讯)综合保健控股(IHH,5225,主板贸服股)总执行长陈诗龙指出,该公司将在未来3年内,投入34亿令吉增加3000张床位。

在今天的股东大会后,陈诗龙表示,目前该公司在区域内的床位共有6000张,并期望在2017年时,可增至9000张。

冀渗透中欧印度中国

“为此,我们将在未来3年内,投入34亿令吉,增加位于土耳其、印度、中国、大马和新加坡医院的床位。”

除了增加床位,他也计划通过收购和自行投资的方式,拓展现有市场的业务。

“我们希望继续渗透中欧、印度和中国市场。我们不排除任何方法,可以是通过收购,买下已有资产和业务的公司,也可以自行设立新医院。我们不限制于任何一种方式。”

今年业绩前景乐观

针对今年业绩表现,陈诗龙仅回应指前景乐观。

“2013财年的营业额和净利,都获得双位数的增长,而这股涨势延续至本财年首季,虽然那是领域的淡季。”

截至3月杪首季,综合保健控股净利上扬24.96%,报1亿5905万2000令吉;营业额则上扬8.18%,达17亿5761万2000令吉。

派息2仙获准

“我不允许公布业绩预测,但就今年的拓展计划、市场需求、有实力的管理层和强稳的业务基础,我对公司的前景向来保持乐观。”

此外,他也同时宣布,股东通过了派发2仙股息的建议,派发期在7月。

“上市后,媒体和股东们都不断在询问何时派息。随着我们首次派发股息,各位可期盼日后我们将最少派出20%净利的股息。”

现金丰无惧高外币贷款

目前,综合保健控股的外币贷款高达3亿5000万美元(11.3亿令吉),然而,该公司总财务长陈时豪对此并不感到担忧。

“美元贷款主要是来自土耳其业务发展。

由于土耳其里拉贷款利息高,而且最近流通率较为紧张,所以我们选择美金。”

他解释,公司手上拥有充裕的现金,且业务盈利贡献稳定,因而不会感到担忧。

“我们手上有约9000万美元(约2.9亿令吉)现金,而且医疗旅游业务每年稳定贡献约8000万美元(约2.6亿令吉),所以没有什么好担心的。”

Source: NanYang

Thursday 19 June 2014

Thursday 12 June 2014

AirAsia making waves in Indonesia, India

KUALA LUMPUR, June 12:

While all attention is focused on AirAsia India’s maiden flight today, the budget carrier group’s unit in Indonesia has again delayed its plans for an initial public offer (IPO) and may be in the running to take over the TigerAir outfit there.

Indonesia’s Transportation Ministry’s director for air transportation Djoko Muratmodjo has reportedly revealed that AirAsia and Garuda’s low-cost subsidiary Citilink are keen to take control of TigerAir Mandala.

The Jakarta Globe quoted Djoko as saying both carriers had submitted proposals to TigerAir Mandala.

The ailing Indonesian unit is 33%-owned by Singapore-based budget airline Tiger Airways while Indonesian private equity firm Saratoga Capital has a 51.3% stake.

“Both the Singaporeans and the Indonesians are eager to cut their losses and dispose of their respective shareholdings before July 1,” the paper reported.

“TigerAir Mandala suspended a big part of its routes in February in an effort to curb mounting costs.”

It isn’t clear if TigerAir Mandala is also a factor why AirAsia Indonesia has delayed its IPO yet again, though group chief executive officer Tan Sri Tony Fernandes was reported by The Jakarta Post as saying it is due to the upcoming presidential election affecting the stock market sentiment.

“We won’t make money at the moment. The market has to be stabilised first. We’ll see how the market goes after the election,” Fernandes had reportedly said.

The paper said AirAsia Indonesia had initially expected to launch an IPO in the third quarter of 2013 and had appointed an underwriter.

Plans by AirAsia Indonesia to open new international routes from the archipelago have also been shelved “due to rising costs in the airline industry resulting from the weakening of the rupiah against the US dollar”.

“AirAsia has tried to develop many international routes but the airport tax keeps going up so we have to cancel routes,” Fernandes had said.

“Indonesian aviation could be massive but costs are going up too fast and its not as affordable as it was.”

To rationalise costs, AirAsia Indonesia has stopped services from Makassar, South Sulawesi, to Surabaya, East Java and to Denpasar, Bali from June 1.

The budget carrier now operates 30 airplanes – covering five main hubs in Bali; Bandung, West Java; Jakarta; Medan, North Sumatra; and Surabaya.

But in India, Fernandes was upbeat as the Indian venture’s maiden flight took off from Bangalore to Goa today and prompting other fiercely competitive budget carriers to match its low fares.

“It’s a proud day for me as my dad was from Goa. He was an amazing man. Down to earth, selfless doctor. He will be proud looking form above,” Fernandes had tweeted.

Based in Chennai, the 49:30:21 joint venture between AirAsia, Tata Sons and Telestra Tradeplace is launching its second route next week linking Bangalore-Chennai.

AirAsia India is eyeing a fleet size of between six and eight by end of 2014, said CEO Mittu Chandilya.

Source: therakyatpost

Wednesday 21 May 2014

Tuesday 20 May 2014

Wednesday 14 May 2014

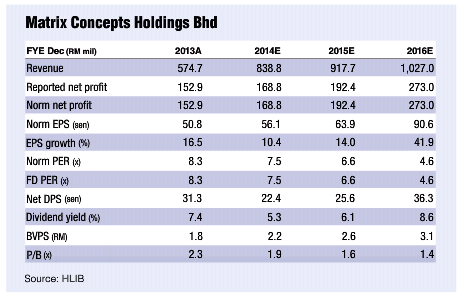

首季业绩稳健 数码网络全年营业额可望成长4-6%

(吉隆坡14日讯)基于数码网络(DIGI,6947,主板基建股)2014財政年首季(截至3月31日止)表现稳健,数码网络首席执行员亨利克劳森有信心,数码网络2014財政年营业额能够取得4至6%的成长。

受到强劲移动网络营业额支撑、成本结构得到改善、和较高资金流动量,亨利克劳森认为,集团在2014年將专注提供更便捷的上网服务,以留住现有1100万名用户和吸引更多新用户。

他表示,公司今年將投入9亿令吉资本开支(CAPEX),以加强它们网络覆盖至86%,包括沙巴及砂拉越地区、增加1500公里长期演进技术(LTE)、延长光纤网络(fibre network)连接,以及改善资讯科技平台能力。

数措施刺激网络使用率对於数码网络的未来计划,他指出,公司將把重心放在移动互联网业务,提供高速连接至更广泛区域、增强数据传输速度和较大容量方案,以刺激用户网络使用率。

「不断地改进互联网技术,主要为了让用户得到更好的网速体验和价值。」亨利克劳森在股东大会上,如此向股东们和媒体表述。

数码网络2014財政年首季(截至3月31日止)税前盈利为4亿8500万令吉,按年上涨47.4%。

数码网络2014財政年首季营业额则按年增加4.23%,至17亿1754万令吉,去年同期为16亿4709万令吉,其中服务营业额则按年成长5.3%。

另外,数码网络首季扣除利息、税项、折旧及摊销前盈利(EBITDA)为7亿7800万令吉,赚幅为45%。

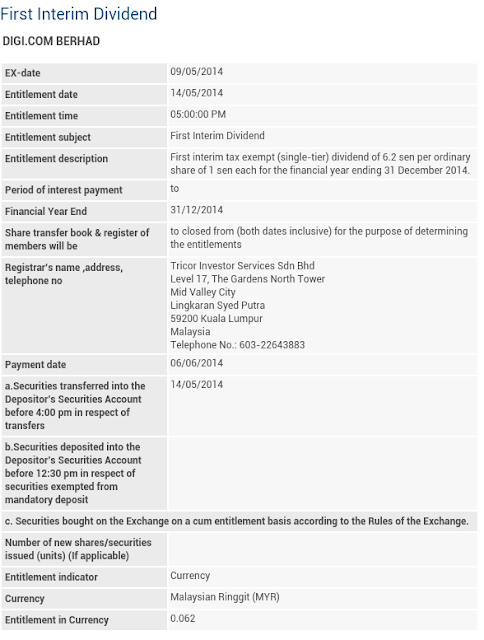

派息6.2仙

配合业绩出炉,该公司建议,派发每股6.2仙的第一次中期免税股息,派发总额为4亿8200万令吉,或相等於99.4%的派息率,已在今日的股东大会上通过。

亨利克劳森表示,数码网络2014財政年將会维持80%股息政策(Dividend Policy),在营业额预期成长4至6%、EBITDA和税前盈利赚幅料改善,公司整体业绩都向好的前提下,派息率將有望高於去年。

「80%股息政策只是我们的基础,今年首季派息率也高达99.4%。」

除此,该公司首席財务员卡尔伊力克(Karl Erik)在股东大会后的记者会上指出,公司2014財政年將会继续受到移动互联网业务的扶持,特別是预付(Prepaid)服务,其移动互联网用户在去年正快速增加。

他指出,预付互联网更为负担得起和具备灵活性;相反,后付(Postpaid)服务用户,每个月固定花费在互联网方面的费用更大。

「后付和预付业务佔数码网络的总业务,分別为15%和85%,而其互联网用户总共有1100万人。」

卡尔伊力克指出,2014財政年的互联网用户將有正面成长,一方面后付互联网业务將在新手机產品的推动下成长;而预付互联网业务也因为其可负担的优势,继续受到用户的青睞。

虽然如此,他认为,公司其实不注重用户人数的多少,重要的互联网的用量大小,现在大部份人都拥有超过1架手机或1张手机用户身份识別(SIM)卡,因此,互联网用量也可相对提振。

另外,卡尔伊力克透露,数码网络並没有搁置设立商业信托架构(BT)的计划,一切仍在计划和商討过程中,而他目前无法给予一个明確的时间。

至於大马通讯与多媒体委员会(MCMC)日前开出11张总值48万令吉的罚单予数码网络,卡尔伊力克指出,从2012年开始,公司一直在改善和提高全马的网络系统,这是整体电信网络变得缓慢或不流畅,及导致公司接获投诉的原因。

但在2014年,公司的网络已经有所改善,他表示,今年的网络通讯將会明显好转。

Source: orientaldaily

Tuesday 13 May 2014

或不延長馬航額外資助 AIR ASIA將成為主要受益者

(吉隆坡12日訊)隨著政府宣布,不再延長對馬航(MAS,3786,主要板貿易)的額外資助,馬航料將趕緊採取措施以保持現金盈余,亞洲航空(AIRASIA,5099,主要板貿易)將成為主要受益者。

根據《星報》報導,馬航重組計劃可能會在本月底掀開面紗,並可能會在7月落實。當中可能會涉及公司破產后對債權人採取保護措施的法庭命令,讓馬航與供應商和員工重新商談條約,又或者是減少僱員人數。

聯昌證券研究指出,如上述般開放的“心臟手術”是馬航相當需要的。在此之前,重組計劃已提出多次,最近一次是在2011年8月。

有望維持穩定盈利

“如果這是一項新重組政策,馬航將可以自保,我們的預測和目標價等都會提高。但是,前進的道路充滿著風險,在過去14年,馬航讓外界太失望,我們不輕易下定論。我們維持虧損預測,維持減持評級不變,目標價為14仙。”

亞航在過去3年內,股價下跌了近35%,目前股價低于清算價值(liquidation value)。公司成本架構相當有效,在競爭激烈的本地市場有望維持穩定盈利,該行給予“增持”評級,目標價2.88令吉。

馬航削減開支,亞航長程(AAX,5238,主要板貿易)雖然也會成為主要受益者,但該行維持“持有”評級,目標價85仙。

今日閉市時,馬航報平盤21仙,成交量達1386萬9400股;亞航起5仙至2.26令吉,成交量達2126萬8100股及亞航長程起0.5仙至75.5仙,成交量達50萬4500股。

Source: ChinaPress

Thursday 8 May 2014

AirAsia wins Indian permit to start airline

NEW DELHI: AirAsia's low-cost Indian joint venture airline has won an operating permit, paving the way for the carrier to launch services and increasing competition in a market where most airlines are losing money.

The Directorate General of Civil Aviation (DGCA) issued the air operator permit, the last approval required to launch an airline, to AirAsia India on Wednesday, a senior government official said. AirAsia India Chief Executive Mittu Chandilya confirmed the company had received the permit.

"I can't wait for us to start flying," he told television channels. "We are working on being the lowest cost (airline)."

It was not immediately known when AirAsia India, a three-way venture between the Malaysia-based low-cost airline, India's Tata Group and investment firm Telestra Tradeplace, would start services.

Earlier plans to start the airline in the last quarter of 2013 were delayed, pending the air operator permit.

An airlines industry body, and a politician of India's main opposition Bharatiya Janata party, which is the favourite to form a government after a general election ending this month, had opposed AirAsia's entry into the Indian market.

AirAsia India has said it will offer one of the lowest fares to lure travellers and will rapidly expand its fleet by adding 10 Airbus A320 planes a year. But the entry of a new competitor is not good news for an industry where all carriers except market leader IndiGo are losing money.

High fuel prices, taxes and fees have squeezed existing Indian airlines. The sector lost a combined $1.3 billion in the financial year to March, according to estimates by aviation consultancy Centre for Asia Pacific Aviation (CAPA).

"Domestic airlines continue to be very precariously placed and AirAsia's entry will further challenge the existing airlines," said Kapil Kaul, South Asia CEO at CAPA.

The arrival of new carriers like AirAsia may lead to a price war and will further hurt passenger yields, Kaul said.

Singapore Airlines' joint venture with the Tata Group to start a full-service airline in India is awaiting an operating permit.

India has five operational national carriers and one regional airline. Competition had eased after the grounding of cash-and-debt-strapped Kingfisher Airlines in October 2012.

In 2012, the Indian government relaxed rules allowing foreign carriers to buy up to 49 percent in an Indian airline. Abu Dhabi's Etihad last year bought 24 percent of Jet Airways , the No.2 carrier by domestic market share. - Reuters

Source: TheStar

Wednesday 7 May 2014

Tuesday 6 May 2014

Monday 5 May 2014

Thursday 1 May 2014

Wednesday 30 April 2014

DiGi hits record high on positive views

KUALA LUMPUR: Shares of DiGi.Com Bhd hit a record high of RM5.52 at mid-afternoon on Wednesday after CIMB Research said DiGi reported good growth in service revenue of 5% on-year in its first quarter.

At 3.24pm, its shares rose 12 sen to RM5.51 with some 6.66 million shares done between the prices of RM5.39 and RM5.52.

The FBM KLCI was up 5.14 points to 1,864.48. Turnover was 1.01 billion shares valued at RM1.25bil. There were 327 gainers, 389 decliners and 311 counters unchanged.

CIMB Research said in a note on Wednesday that it believes DiGi will continue to gain market share.

“All in all we think DiGi should be able to deliver revenue growth of 6% driven by its expanding 3G network coverage and distribution network.

“This will help it continue to gain revenue market share and we estimate it will build ebitda margin from 45.5% in FY13 to over 46% over the next two years,” it said.

Source: TheStar

Friday 25 April 2014

Wednesday 23 April 2014

Tuesday 22 April 2014

Saturday 19 April 2014

KLIA2 is now certified fit for use

PETALING JAYA: KLIA2 has finally been given the long awaited Certificate of Completion and Compliance (CCC) on Friday.

The certificate was handed over by the main contractors, the UEM-Bina Puri consortium to Malaysia Airports Holdings Bhd, in a ceremony on Friday.

There are three parts to the issuance of a CCC; it needs to comply with the Fire and Rescue Department, Sepang Municipal Council and Indah Water Konsortium Sdn Bhd (IWK) specifications and KLIA2 has complied with all the conditions and is now certified safe for use.

The Operational Readiness and Airport Transfer (Orat) procedures has been under way for over a month now and the new low cost air terminal will open for operations on May 2.

Orat is a comprehensive methodology and holistic approach employed to ensure the operational readiness of a new airport or airport infrastructure project.

Five airlines – Malindo Air, Cebu Pacific Air, Tiger Airways Singapore, Lion Air and Indonesia’s Mandala Airlines will begin operations on May 2 and AirAsia will join in before May 9. On May 9, the existing LCCT will cease operations.

Source: TheStar

Thursday 17 April 2014

AirAsia to implement AMI service

PETALING JAYA: AirAsia Bhd has signed an agreement to implement the Airbus Managed Inventory (AMI) service for its A320 and A330 fleets at its bases in Kuala Lumpur and Bangkok.

In a statement released by Airbus, the AMI service ensures the automatic and continuous replenishment of high-usage and non-repairable parts at the customer's facilities.

AirAsia is confident that the AMI service will support the company and its associated company AirAsia X in paving the way for low-cost aviation through innovative solutions and efficient processes.

"With AMI, we will minimise our spares investment costs while maximising delivery of parts when needed," said Anaz Ahmad Tajuddin, group head of engineering of AirAsia.

AirAsia is the fourth customer in the region to choose the AMI automated inventory management solution, which works to reduce inventory holding costs.

This is done by capturing material consumption information in real-time and automatically triggering replenishment orders within the agreed inventory levels, the service guarantees high on-shelf part availability while decreasing the overall inventory stock level.

Wednesday 16 April 2014

AirAsia Group says will move into KLIA2 by May 9

KUALA LUMPUR: AirAsia Group says it will move to KLIA2 by May 9 although there are still a few outstanding commercial issues.

“We will be notifying all of our guests accordingly to ensure a smooth transition from the current LCC Terminal to KLIA2,” according to the joint statement issued by AirAsia executive chairman Datuk Kamarudin Meranun and AirAsia X Bhd chairman Tan Sri Rafidah Aziz on Tuesday.

They said the group expressed its appreciation to Prime Minister Datuk Seri Najib Razak and the government for the decision to enlist the expertise of the International Civil Aviation Organization (ICAO) to further evaluate KLIA2 and to determine the long term safety of the new airport.

“This decision reflects the priority that the government is giving to the issue of safety, and assuring the public that KLIA2 is safe. We are very grateful for this priority that the government has placed on this issue.

“Although there are still a few outstanding commercial issues, this should not hold back our operations at KLIA2 as planned. As such, AirAsia Group will move into KLIA2 by May 9, 2014,” they said in the statement.

Kamarudin and Rafidah said AirAsia and AirAsia X were looking forward to operate from KLIA2, as well as to the next stage of our growth and development through KLIA2.

They said ongoing discussions with relevant authorities were in progress.

“However, should the negotiations not be completed or concluded expeditiously, we hope the Government will be able to provide necessary mediation, in order to enable MAHB (Malaysia Airports Holdings Bhd) to get its dues as the airport operator; and at the same time, enabling the AirAsia Group to efficiently operate based on our proven low-cost carrier business model through reasonable charges and levies,” they said in the statement.

Source: TheStar

Tuesday 15 April 2014

Monday 14 April 2014

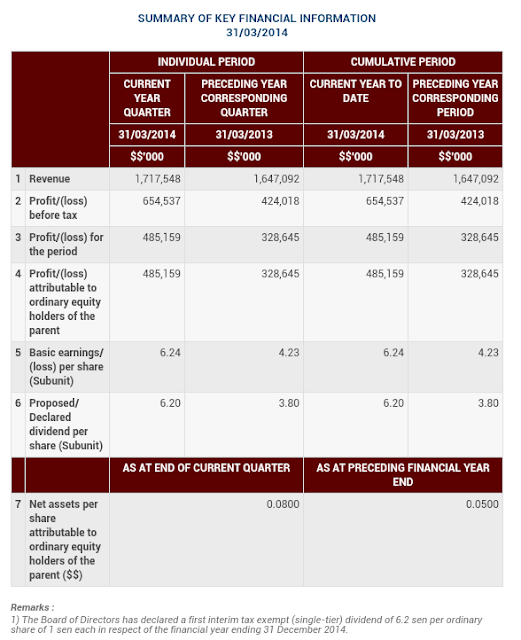

Matrix proposes 1 for 2 bonus issue

PETALING JAYA: Matrix Concepts Holdings Bhd proposes to undertake a bonus issue on the basis of one bonus share for every two existing shares held by shareholders.

In a filing with Bursa Malaysia, the bonus issue entails a issuance of up to 152.88 million new ordinary shares of RM1.00 each.

The maximum scenario would then result in the group's share capital increasing from RM301.17 million comprising 301.17 million shares of RM1.00 each as at Dec 31, 2013, to RM458.65 million comprising 458.65 million shares of RM1.00 each.

"The bonus issue is in tandem with our current scale of operations, and is anticipated to allow greater participation in the equity of the group," said its chairman Datuk Mohamad Haslah.

The bonus issue is targeted for completion by the third quarter of 2014.

The company also confirms that based on the audited financial statements for the financial year ended Dec 31, 2013, it will have adequate share premium and retained profits to cover the capitalisation required for the bonus issue after the completion of the receipt of dividend.

The bonus issue is targeted for completion by the third quarter of 2014.

Source: Thesundaily

Friday 11 April 2014

Friday 4 April 2014

Thursday 3 April 2014

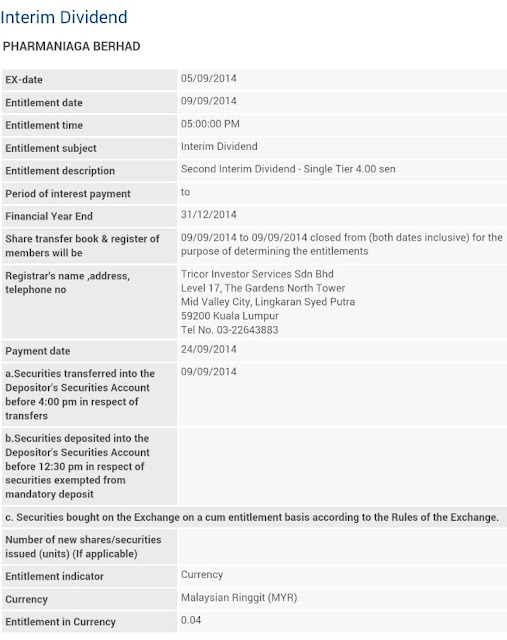

Pharmaniaga ties up with Saudi firm to build RM120mil factory in Riyadh

PETALING JAYA: Pharmaniaga Bhd is teaming up with Modern Group, one of the largest companies in Saudi Arabia, to build a RM120mil manufacturing plant in Riyadh.

Pharmaniaga chairman Tan Sri Lodin Wok Kamaruddin said the 50:50 joint venture was part of the company’s strategy to accelerate the growth of its pharmaceutical business and to capture the rapidly growing opportunities in Saudi Arabia.

Lodin said besides its plants in Saudi Arabia and Indonesia, which it acquired last year, the generic drug maker also aimed to penetrate other Asean countries such as Myanmar, Vietnam, the Philippines and Thailand.

“At the same time, we are looking at enhancing our retail pharmacy outlets.

“At present, we have one in Shah Alam under the Royale Pharma brand.

“We are now working closely with several organisations and companies to see if we can establish more outlets in the country,” he told a media briefing after Pharmaniaga’s annual general meeting here yesterday.

He added that Pharmaniaga’s parent company, Boustead group, owned and operated more than 300 petrol kiosks nationwide and soon all these locations would be selling the Royale Pharma products.

Pharmaniaga reported a lower pre-tax profit of RM93mil for the year ended Dec 31, 2013, down 10% from RM103mil previously.

However, its revenue rose to RM1.9bil from RM1.8bil a year ago.

This was attributable to strong contributions from the group’s non-concession business and organic growth in the concession business as well as new tenders that it secured. — Bernama

Source: http://www.thestar.com.my/Business/Business-News/2014/04/03/Pharmaniaga-ties-up-with-Saudi-firm-Joint-venture-to-build-RM120mil-factory-in-Riyadh/

Wednesday 2 April 2014

AirAsia CEO appeals for PM's intervention in klia2 issue

KUALA LUMPUR: AirAsia Bhd is appealing for Datuk Seri Najib Tun Razak to intervene in resolving the klia2 issue as it wants to be given a voice since it will be the main user of the terminal.

The low-cost carrier's CEO Aireen Omar said on Wednesday the Prime Minister's intervention was crucial in resolving this national issue.

She pointed out the airline was ready and committed to make the best out of klia2 "although it is not the design we wanted."

The klia2, she added, was longer a fully low-cost carrier terminal as initially promised by Malaysia Airports Holding Bhd (MAHB).

Aireen was clarifying news reports over AirAsia's decision to remain in the current low-cost carrier terminal after May 9, 2014.

She said while AirAsia was more than ready to move to klia2 but the shift must be done under the right circumstances.

"We will be the anchor tenant at the new airport, accounting for more than 80% of klia2's traffic, hence the critical need for klia2 to be fully functional and operationally viable in the long term," she said.

She said the articles could have given rise to a perception that AirAsia was not deliberately moving to klia2 or being difficult on purpose.

However, she assured this was not its intention as there were many concerns especially functionality, safety and security of klia2.

"Klia2 has the potential to be a global aviation hub, just like Dubai. AirAsia, as the largest low cost carrier in the region can and will contribute towards making that a reality, directly elevating the nation's aviation industry as a whole.

"As a major contributor to Malaysia's economy, AirAsia must be given a voice as we are the main user of klia2. AirAsia looks forward to resolve this issue as soon as possible," Aireen added.

http://www.thestar.com.my/Business/Business-News/2014/04/02/AirAsia-CEO-wants-PM-to-intervene-in-klia2-issue